Optimizing Business Funding Opportunities to Accelerate Your Consultancy

Wiki Article

Everything About Service Financing: Essential Insights for Aspiring Management Professional

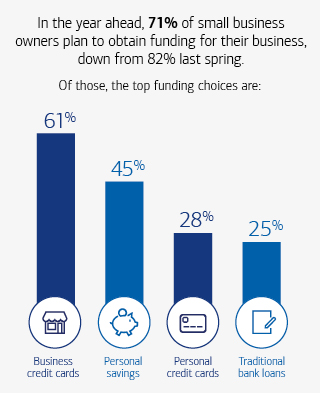

Organization funding presents an intricate landscape that striving management consultants should navigate. From traditional financial institution fundings to innovative crowdfunding platforms, each alternative lugs its very own nuances and effects (Business Funding). Comprehending these diverse financing resources is crucial for providing informed guidance to clients. The possibility of grants and the involvement of angel financiers add additional layers to this complex procedure. What strategies can consultants take advantage of to aid businesses in securing the needed funding for development?Comprehending the Different Kinds Of Business Financing

Alternate funding sources have gained traction, consisting of crowdfunding, peer-to-peer borrowing, and angel capitalists, which supply innovative options for organizations looking for capital without standard banking courses. Each financing type provides unique advantages and challenges, and the selection relies on business's stage, monetary wellness, and growth purposes. By thoroughly understanding these alternatives, monitoring consultants can provide very useful guidance, aiding their customers make educated decisions that straighten with their critical objectives.

Exploring Traditional Bank Loans

Standard financial institution car loans continue to be a preferred selection for organizations seeking financing, making up a considerable portion of financing options offered today. These loans commonly provide fixed rate of interest and repayment terms, offering a steady monetary structure for companies. To qualify, business normally need to show solid credit reliability, a solid business plan, and sufficient collateral.The application procedure can be strenuous, typically requiring comprehensive monetary declarations and individual assurances. Authorization timelines might vary, yet organizations must expect numerous weeks for processing.

While traditional small business loan can supply considerable financing, they likewise come with threats. Failure to pay back can bring about loss of security and damage to debt rankings. Nonetheless, when taken care of effectively, these fundings can allow services to spend in development initiatives, purchase tools, or handle money circulation efficiently. Generally, standard small business loan offer a trusted funding resource for companies all set to fulfill the associated demands.

The Function of Equity Capital in Startups

Equity capital plays a necessary duty in the development of startups by supplying important financing that can drive advancement and scalability. Different kinds of financial backing, such as seed financing and growth equity, satisfy different phases of a company's advancement. The benefits for start-ups include not just financial assistance but additionally access to important networks and knowledge that can boost their chances of success.Kinds Of Financial Backing

Financing alternatives for startups usually include numerous types of equity capital, each tailored to meet particular business demands and phases of development. Seed resources is usually the first round of funding, intended at early-stage startups to develop first product and services. Collection A financing follows, supplying funding for scaling the service and optimizing product-market fit. Collection B and C rounds concentrate on further development, improving operations, and entering brand-new markets. Furthermore, equity capital can be categorized right into different sectors, such as health care, technology, and consumer goods, allowing capitalists to align with their competence and rate of interests. Each type of equity capital serves unique functions, making sure that start-ups receive appropriate assistance throughout their developmental trip.Advantages for Startups

Accessing financial backing can considerably improve a startup's capacity for success. This funding resource provides not only financial sources but additionally tactical advice from experienced financiers. Venture capitalists often bring valuable sector links, assisting in partnerships and collaborations that can thrust a startup onward. On top of that, the influx of capital enables startups to purchase research and marketing, skill, and growth procurement, allowing them to scale quickly. The support of trusted equity capital companies can also enhance a start-up's credibility, bring in even more financial investment and client count on. Moreover, endeavor plutocrats normally offer mentorship, aiding start-ups browse obstacles and refine their company methods. Generally, equity capital plays an essential function in transforming innovative concepts into thriving site link services, significantly enhancing their opportunities of long-term success.Harnessing the Power of Crowdfunding

Crowdfunding has actually emerged as a vital financing source for businesses, offering various platform kinds customized to various demands. Understanding these platforms and utilizing efficient project approaches can considerably enhance the chances of success. Monitoring professionals can leverage this expertise to guide clients in passing through the crowdfunding landscape successfully.Kinds Of Crowdfunding Operatings Systems

Exactly how can administration consultants properly utilize crowdfunding to sustain their jobs? Understanding the sorts of crowdfunding platforms is essential. There are largely 4 classifications: donation-based, reward-based, equity-based, and debt-based crowdfunding. Donation-based platforms permit backers to add without expecting anything in return; ideal for reasons or social jobs. Reward-based platforms supply concrete benefits or experiences in exchange for contributions, bring in creative jobs - Business Funding. Equity-based crowdfunding makes it possible for capitalists to acquire shares in a firm, appealing to startups looking for significant financing. Debt-based crowdfunding includes borrowing funds from multiple individuals, with a pledge to repay them with rate of interest. By identifying these options, management specialists can choose one of the most ideal platform to straighten with their job objectives and audienceSuccessful Project Approaches

Efficient campaign methods are essential for management consultants aiming to harness the power of crowdfunding. An engaging story is essential; it ought top article to share the job's vision and effect, engaging possible backers psychologically. Visual storytelling, making use of video clips and pictures, can considerably improve allure. In addition, establishing sensible financing goals cultivates trust and motivates participation. Experts should additionally take advantage of social media systems to widen reach and create buzz around the campaign. Normal updates keep backers notified and invested, maintaining momentum throughout the project. Using attractive incentives can incentivize contributions, while producing early bird specials can spur initial interest. Ultimately, a tactical project method can change ideas into financed realities, encouraging consultants to accomplish their business goals with crowdfunding.Involving With Angel Investors

Engaging with angel financiers can be a crucial step for monitoring consultants looking for to safeguard funding for innovative jobs. These affluent people normally invest their individual funds in early-stage ventures, offering not simply funding however additionally invaluable mentorship. To draw in angel investors, management specialists need to present an engaging service plan that highlights the project's possibility for growth and profitability.

Structure connections is important; consultants must network within sector circles to identify prospective investors. Showing sector knowledge and a clear vision can cultivate trust and interest. A well-crafted pitch, customized to the investor's passions, will improve the possibilities of securing funding.

In addition, experts should be prepared to attend to potential issues concerning returns and dangers. Openness and open communication can enhance these connections, ultimately resulting in fruitful collaborations. Involving efficiently with angel capitalists can considerably affect the trajectory of an administration consultant's task, allowing them to understand their vision.

Browsing Grants and Federal Government Financing Options

For monitoring specialists, discovering grants and government financing choices can use an alternate pathway to protect funds beyond exclusive financial investments. These moneying resources are typically created to sustain particular industries, projects, or community initiatives, offering one-of-a-kind chances for consultants to align their solutions with funding goals.Experts should start by researching available gives at local, state, and federal degrees, concentrating on programs that line up with their areas of experience. Many federal government companies provide comprehensive standards on eligibility and application procedures, making it crucial for professionals to acquaint themselves with these needs.

Networking with market associations and attending informative workshops can additionally improve understanding of the landscape. In addition, preserving clear paperwork and demonstrating the possible impact of proposed tasks can strengthen applications. Business Funding. By purposefully leveraging grants and federal government financing, management specialists can not only improve their economic stability but additionally contribute favorably to their neighborhoods

Frequently Asked Questions

How Can I Improve My Funding Application Success Price?

To boost financing my review here application success rates, one must research study financing sources extensively, tailor applications to certain requirements, existing clear and compelling narratives, and look for comments from peers or mentors before entry for useful insights.What Prevail Blunders to Stay Clear Of When Seeking Funding?

Usual errors to stay clear of when looking for financing consist of inadequate research study, uncertain goals, bad economic forecasts, ignoring to customize applications for certain investors, and failing to demonstrate a strong administration team or market understanding.The length of time Does the Funding Refine Normally Take?

The funding process generally takes anywhere from a couple of weeks to numerous months, depending on numerous aspects such as the sort of funding sought, the preparation of paperwork, and the responsiveness of the entailed celebrations.Can I Fund My Consultancy Without Personal Financial Investment?

Yes, one can money a consultancy without personal investment by looking for outside resources such as financings, investors, or grants. Safeguarding funding commonly needs a solid service plan and showing potential productivity to bring in interest.What Is the Influence of Credit Score on Funding Options?

A credit report considerably influences funding options, influencing lenders' decisions on car loan authorizations and rates of interest. Greater scores usually lead to far better terms, while reduced ratings may limit access to financing or boost loaning prices.

Company financing presents a complicated landscape that aiming administration consultants have to browse. As monitoring experts browse the landscape of business funding, comprehending the different choices readily available is necessary for their customers' success. Business funding can be extensively classified right into equity financing, financial obligation financing, and alternative funding sources. Alternate financing resources have gained traction, including crowdfunding, peer-to-peer lending, and angel capitalists, which supply ingenious solutions for companies seeking resources without traditional financial routes. Financing choices for start-ups often include different kinds of venture capital, each tailored to meet certain company needs and stages of growth.

Report this wiki page